2023 Medicare Costs

Medicare is a government-funded healthcare program that provides coverage for millions of Americans aged 65 and older, as well as certain younger individuals with disabilities. However, like with any insurance plan, there are costs associated with Medicare. In this article, we will discuss the costs of Medicare Part A, Part B, Part C, and Part D. Specifically, we will delve into the monthly premiums and deductibles for Part A and Part B, as well as the monthly premiums for Part C and Part D. It’s important to understand these costs so that you can make informed decisions about your healthcare coverage and budget accordingly.

Medicare Part A (Hospital Insurance) Costs

Part A monthly premium- In general, most people do not need to pay a monthly premium for Part A because they have already paid Medicare taxes while working. However, if you are not eligible for premium-free Part A, you may need to pay up to $506 per month. It’s important to note that if you do not sign up for Part A when you first become eligible for Medicare at age 65, you may be subject to a penalty.

Hospital stay – In 2023, you pay:

- $1,600 deductible per benefit period

- $0 for the first 60 days of each benefit period

- $400 per day for days 61–90 of each benefit period

- $800 per “lifetime reserve day” after day 90 of each benefit period (up to a maximum of 60 days over your lifetime)

Skilled Nursing Facility stay – In 2023, you pay:

- $0 for the first 20 days of each benefit period

- $200 per day for days 21–100 of each benefit period

- All costs for each day after day 100 of the benefit period

Medicare Part B (Medical Insurance) Costs

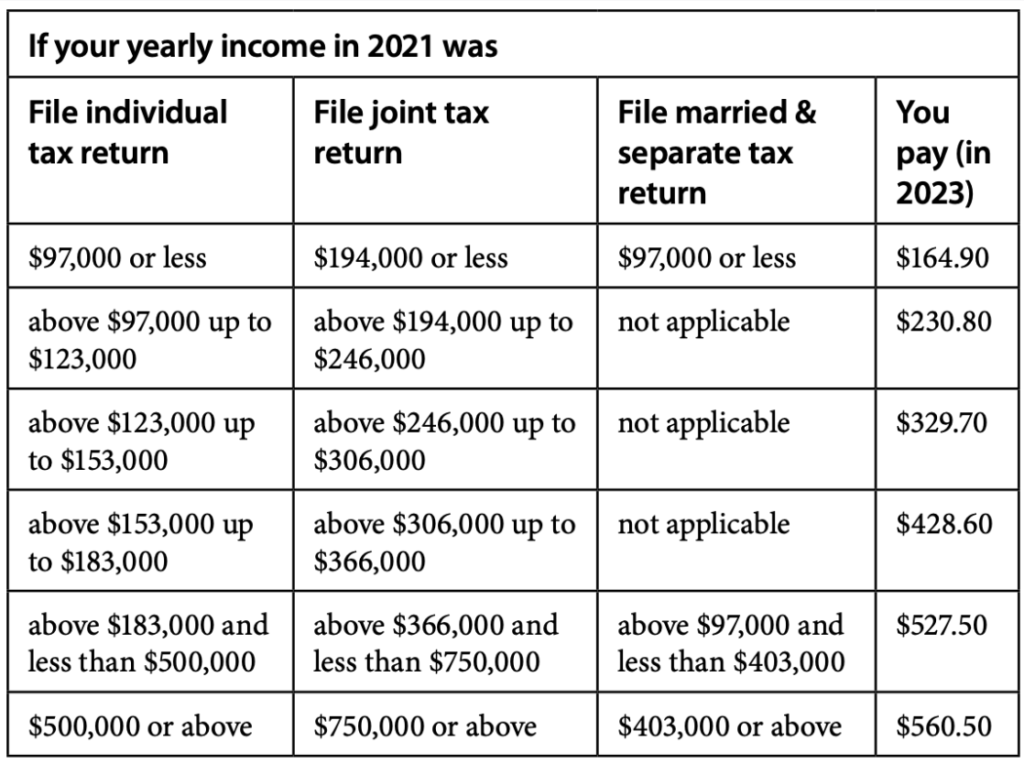

Part B monthly premium- Medicare Part B, which is the medical insurance component of Medicare, has a monthly premium cost that most people pay at a standard rate. As of 2023, the standard Part B premium is $164.90 per month.

The exact amount that each individual will pay for Part B in 2023 will be determined by Social Security. The standard premium amount applies to those who enroll in Part B for the first time in 2023, don’t receive Social Security benefits, are directly billed for their Part B premiums, or have Medicare and Medicaid with Medicaid paying their premiums. If an individual’s state pays the premiums, the standard premium amount of $164.90 will apply.

However, if an individual’s modified adjusted gross income as reported on their IRS tax return from two years ago is above a certain amount, they will have to pay the standard Part B premium as well as an income-related monthly adjustment amount.

Medicare Advantage Plans (Part C) & Medicare Drug Coverage (Part D) Premiums

Medicare Advantage plans, also known as Medicare Part C, vary in price depending on several factors. One factor is the specific plan you choose, as different plans offer varying levels of coverage and benefits. Additionally, the location where you live can also affect the cost of your plan, as healthcare costs can vary depending on the region.

Part D Monthly Premium

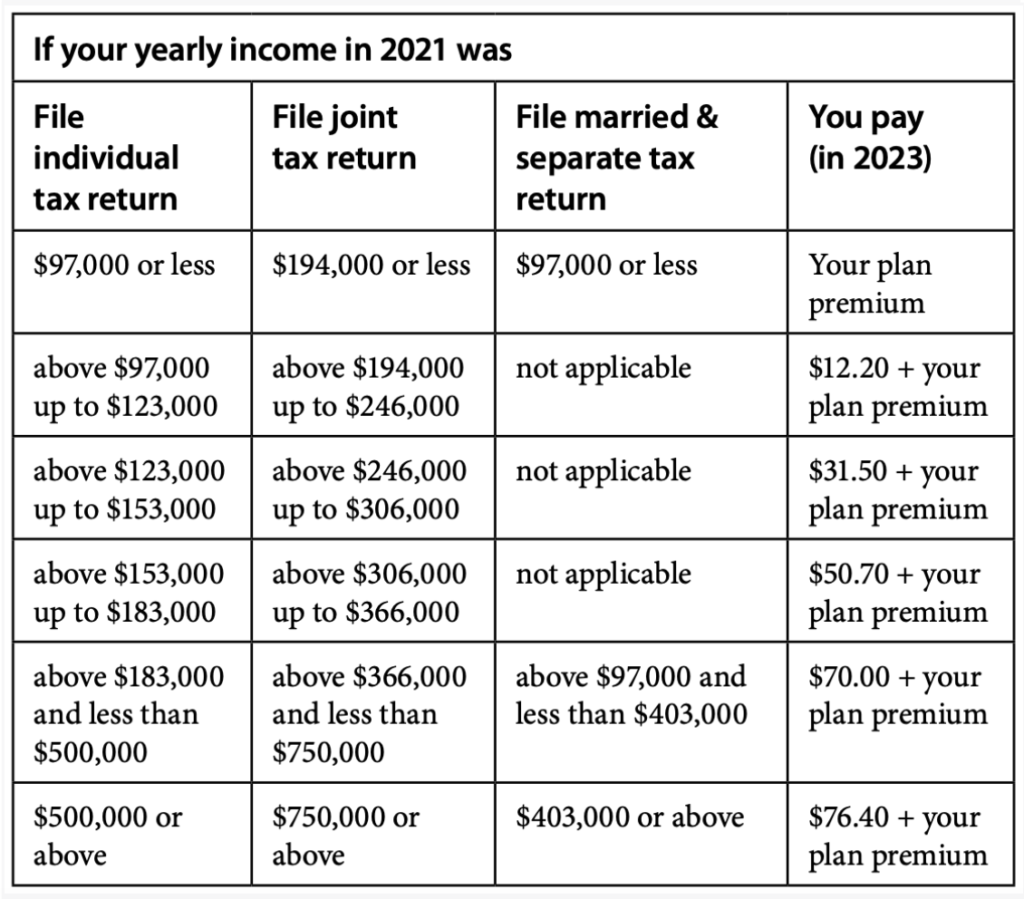

The 2023 Part D national base beneficiary premium is $32.74. This premium is used to calculate the Part D late enrollment penalty and the income-related monthly adjustment amounts. It’s important to note that the national base beneficiary premium can change each year, and if you pay a late enrollment penalty, the amounts you owe may be higher.

The following chart displays an estimate of your monthly premium for the drug plan based on your income. If your income exceeds a particular threshold, you will need to pay an additional amount called an income-related monthly adjustment along with your plan premium.

Its important that you work with a Medicare advisor to understand your unique situation and get you accurate Medicare costs for 2023. The team at Plan Medicare is licensed with dozens of carriers in all 50 states. Call us for your free Medicare planning consultation.