2024 Medicare Costs

Medicare is a government-funded healthcare program that provides coverage for millions of Americans aged 65 and older, as well as certain younger individuals with disabilities. However, like with any insurance plan, there are costs associated with Medicare. In this article, we will discuss the costs of Medicare Part A, Part B, Part C, and Part D. Specifically, we will delve into the monthly premiums and deductibles for Part A and Part B, as well as the monthly premiums for Part C and Part D. It’s important to understand these costs so that you can make informed decisions about your healthcare coverage and budget accordingly.

Medicare Part A (Hospital Insurance) Costs

In general, the majority of individuals don’t need to pay a monthly premium for Medicare Part A because they or their spouse have already contributed to Medicare taxes while employed. The requirement for this “premium-free Part A” is typically a minimum of 10 years (or 40 quarters) of Medicare-taxed employment.

Eligibility for Premium-Free Part A

If you’re wondering whether you qualify for premium-free Part A, the key factor is your work history or that of your spouse. Generally, those who have worked and paid Medicare taxes for at least 10 years are eligible. Moreover, if you become a Medicare recipient before the age of 65, you won’t have to pay a premium for Part A.

Costs for Those Not Eligible for Premium-Free Part A

However, if you haven’t met the qualifications for premium-free Part A, you still have the option to purchase it. The monthly cost in 2024 will either be $278 or $505, depending on the length of time you or your spouse worked and contributed to Medicare taxes.

Late Enrollment Penalty

It’s crucial to be aware that if you don’t sign up for Part A when you initially become eligible at age 65, you might face a penalty, which could increase your monthly premium when you eventually do enroll.

Hospital stay – In 2024, you pay:

- $1,632 deductible per benefit period

- $0 for the first 60 days of each benefit period

- $408 per day for days 61–90 of each benefit period

- $816 per “lifetime reserve day” after day 90 of each benefit period (up to a maximum of 60 days over your lifetime)

Skilled Nursing Facility stay – In 2024, you pay:

- $0 for the first 20 days of each benefit period

- $204 per day for days 21–100 of each benefit period

- All costs for each day after day 100 of the benefit period

Medicare Part B (Medical Insurance) Costs

Part B monthly premium

Medicare Part B covers medical services and has a monthly premium that varies depending on several factors. As of 2024, the standard monthly premium for Part B is $174.70.

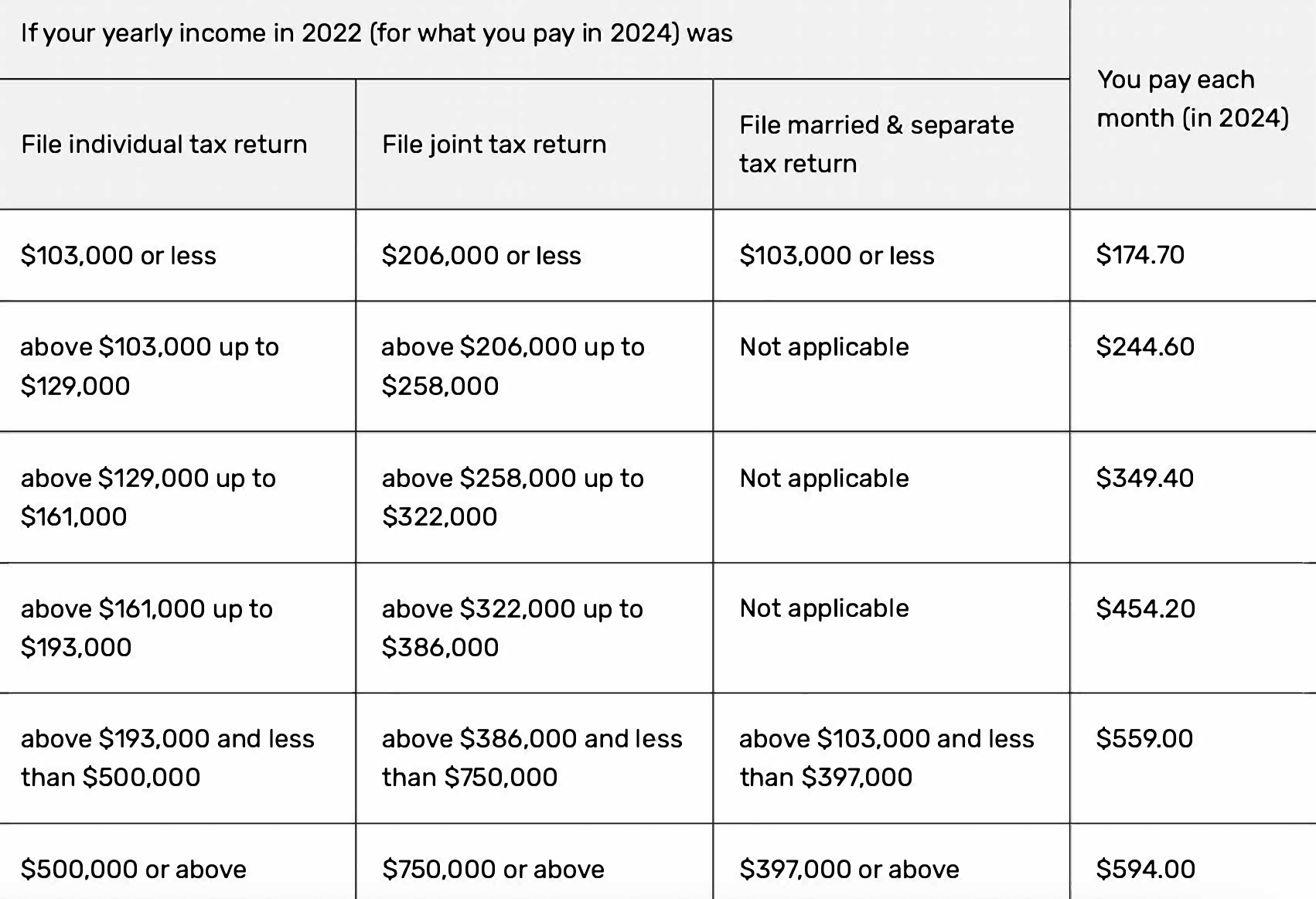

Income-Related Adjustments

If your modified adjusted gross income, as reported on your IRS tax return from two years prior, exceeds a certain threshold, you’ll be subject to an income-related monthly adjustment amount in addition to the standard premium. This means you could end up paying more than the standard $174.70, and this amount can change annually.

Penalties and General Costs

Failure to sign up for Part B when first eligible—usually at age 65—will result in a monthly penalty. This penalty increases the longer you delay enrollment and will apply as long as you have Part B.

Deductible

Additionally, there is an annual deductible ($240 in 2024) that must be paid before Original Medicare begins covering costs. Once the deductible is met, you may also be responsible for coinsurance for Part B-covered services.

Medicare Advantage Plans (Part C) & Medicare Drug Coverage (Part D) Premiums

Medicare Advantage plans, also known as Medicare Part C, vary in price depending on several factors. One factor is the specific plan you choose, as different plans offer varying levels of coverage and benefits. Additionally, the location where you live can also affect the cost of your plan, as healthcare costs can vary depending on the region.

Part D Monthly Premium

The Part D national base beneficiary premium for 2024 is $34.70. This amount serves as the basis for calculating both the late enrollment penalty and any income-related monthly adjustment amounts. It’s crucial to understand that this national base beneficiary premium can change annually. If you incur a late enrollment penalty, the premium you owe could be higher.

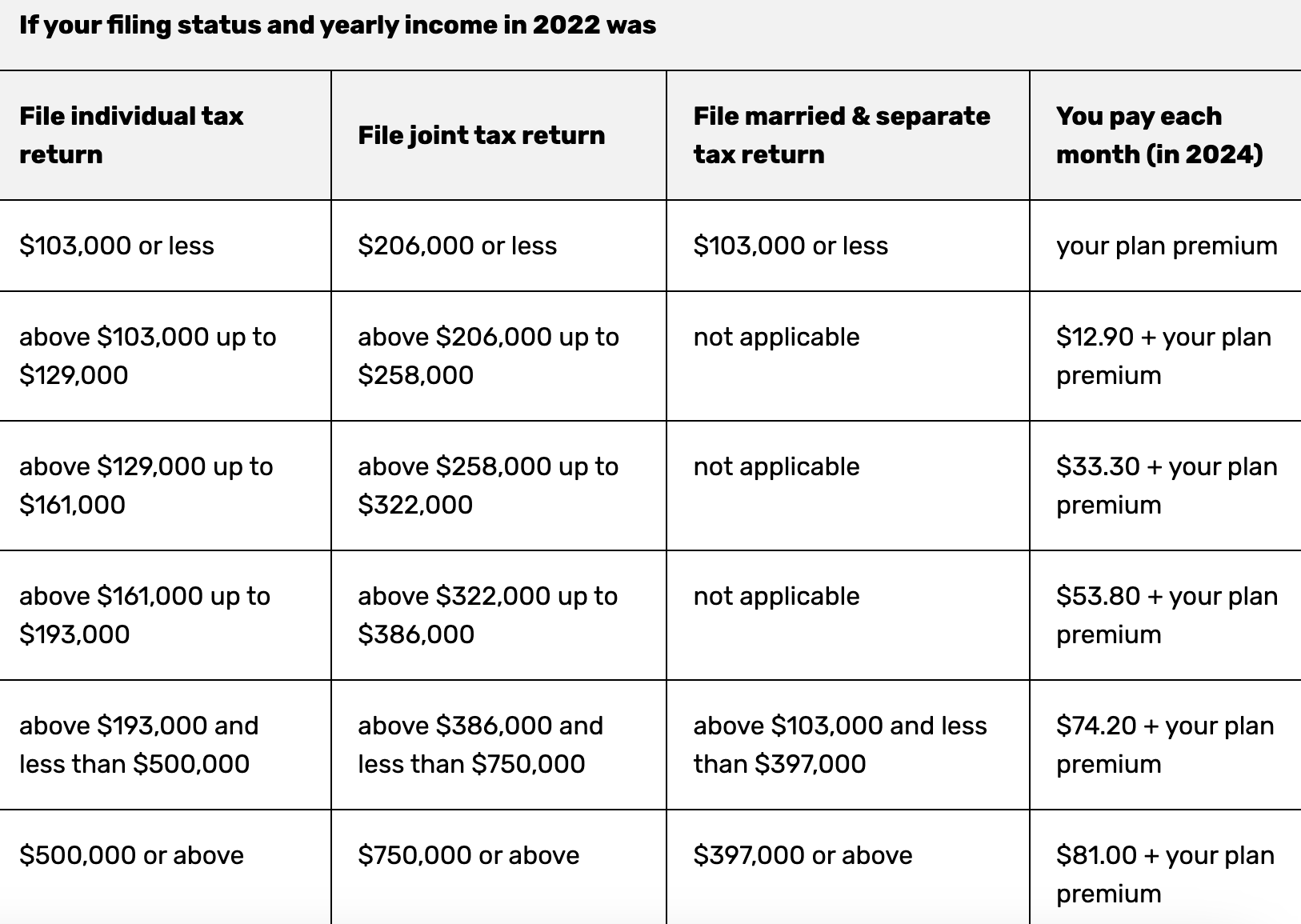

Income-Related Adjustments

Individuals with income above a certain level will have to pay an income-related monthly adjustment amount in addition to their standard premium. The exact amount will depend on your specific income and the guidelines set forth by Medicare.

Avoid paying a penalty:

To steer clear of late enrollment penalties, it’s advised to:

- Enroll in a Medicare drug plan when you first become eligible for Medicare Part A and/or Part B.

- Maintain continuous drug coverage that is at least as comprehensive as Part D (known as “creditable coverage”) and avoid going 63 days or more without such coverage.

Its important that you work with a Medicare advisor to understand your unique situation and get you accurate Medicare costs for 2024. The team at Plan Medicare is licensed with dozens of carriers in all 50 states. Call us for your free Medicare planning consultation.